2025 Earnings Limit For Social Security 2025. There is no earnings cap after hitting full retirement age. As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security taxes.

We use the following earnings limits to reduce your benefits: People born from july 2, 1957, through may 1, 1958, will reach it in 2025.

Workers who collect social security before full retirement age can have benefits reduced when their earnings exceed a certain threshold.

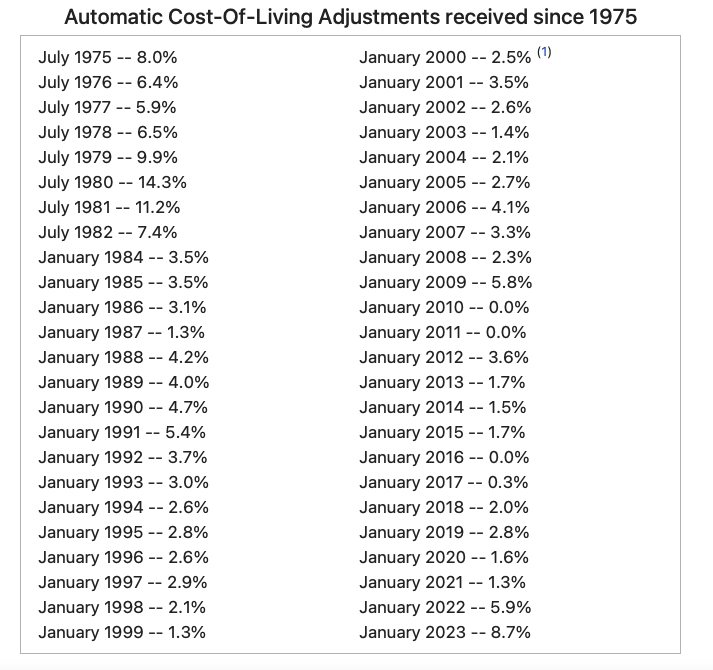

2025 Earnings Limit Jere Robina, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi) payments in 2025.

Social Security Pay Chart 2025 Elise Corabella, In fact, you’ll have to earn at least the maximum wage base for at least 35 years. Maximum ssa benefit in 2025.

Ssi Benefits Payments Schedule 2025 2025 Doria Gaylene, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). There is no earnings cap after hitting full retirement age.

Fy 2025 Limits Documentation System Image to u, On average, social security retirement benefits will increase by more than $50 per month starting in january. For people attaining nra in 2025 , the annual exempt amount is $59,520.

Irmaa 2025 Limits Jayme Iolande, For people attaining nra after 2025 , the annual exempt amount in 2025 is $22,320. The income limit for workers who are under the full retirement age will increase to $22,320 annually, with income above the limit having $1 deducted from benefits for every $2 earned above.

2025 Social Security Limit YouTube, For people attaining nra after 2025 , the annual exempt amount in 2025 is $22,320. If you claim social security benefits and you are younger than your full retirement age of 65 to 67 (depending on your year of birth), you will be.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Social security wage base increases to $168,600 in 2025. If you claim social security benefits and you are younger than your full retirement age of 65 to 67 (depending on your year of birth), you will be.

Extra Help Part D Limits 2025 Luci Simona, If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. Earn at or below that amount in 2025 and it will have no affect on your special retirement supplement for 2025.

Irs Hsa 2025 Contribution Limits Avis Kameko, There is no earnings cap after hitting full retirement age. On average, social security retirement benefits will increase by more than $50 per month starting in january.

Social Security Increase 2025 Suggest Wise, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). If you claim social security benefits and you are younger than your full retirement age of 65 to 67 (depending on your year of birth), you will be.

The maximum amount of earnings subject to the social security tax (taxable maximum) will increase to $168,600.