Other tax cuts and reforms. As expected, the central government neither tweaked nor put any additional.

In cbo’s projections, real consumer spending increases by 1.3 percent in 2025, roughly half of last year’s growth rate, and then rebounds in 2025 to grow by 1.9 percent.

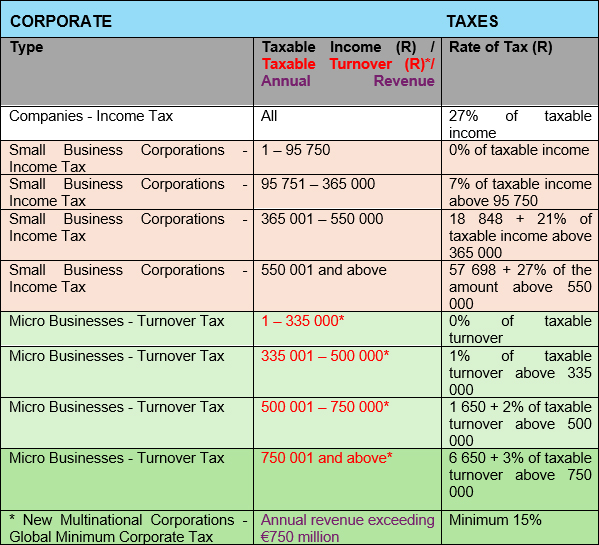

Budget 2025 Your Tax Tables and Tax Calculator • CA(SA)DotNews, Income tax slab budget 2025 highlights: As expected, the central government neither tweaked nor put any additional.

Budget for fiscal year 202324 Tax waivers counted in subsidy account, Why some parents effectively pay a 71% tax rate; As expected, the central government neither tweaked nor put any additional.

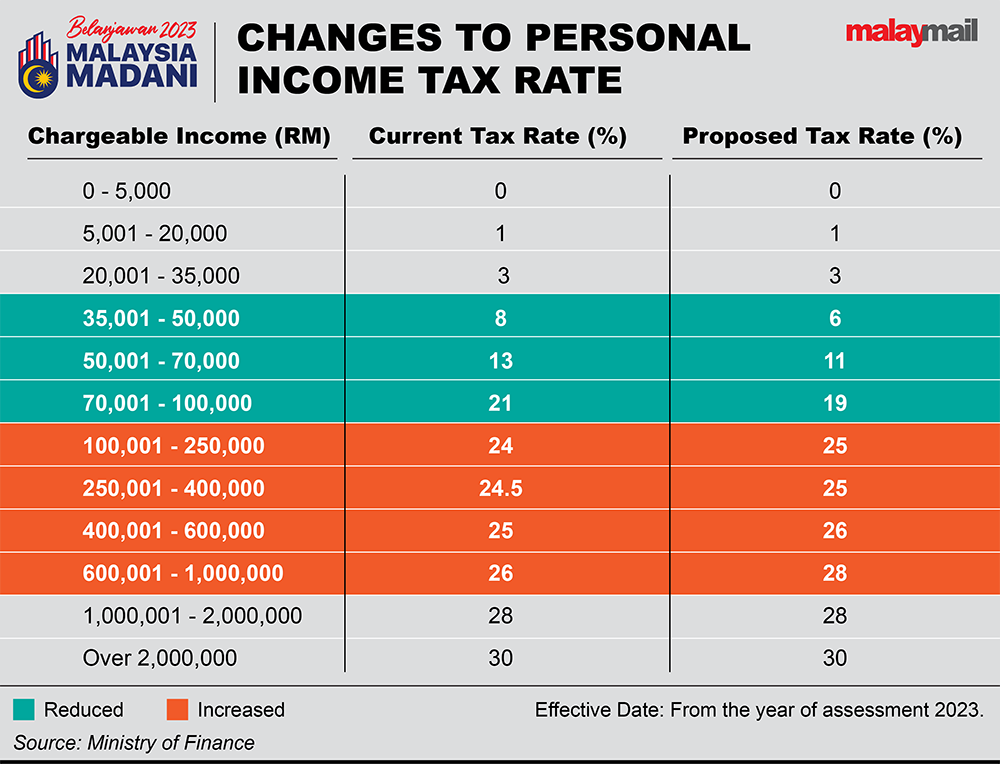

Why no tax rate rise for those earning above RM1m? Treasury sec, The following is a summary of selected tax proposals included in the 2025 budget: Department of public expenditure, ndp delivery and reform published on 10 october.

Tax rates for the 2025 year of assessment Just One Lap, The national minimum wage will increase by €1.40 to €12.70 per hour from 1 january 2025. Updated april 17, 2025 3:41 pm.

Fiscal Year 2025 Budget Documents Biddeford, ME, On taxation changes, the government will spend at least €1.2 billion, which is a small enough envelope once all the demands are. This document sets out the detail of each tax policy measure announced at spring budget 2025 and of previously announced measures that will be included in.

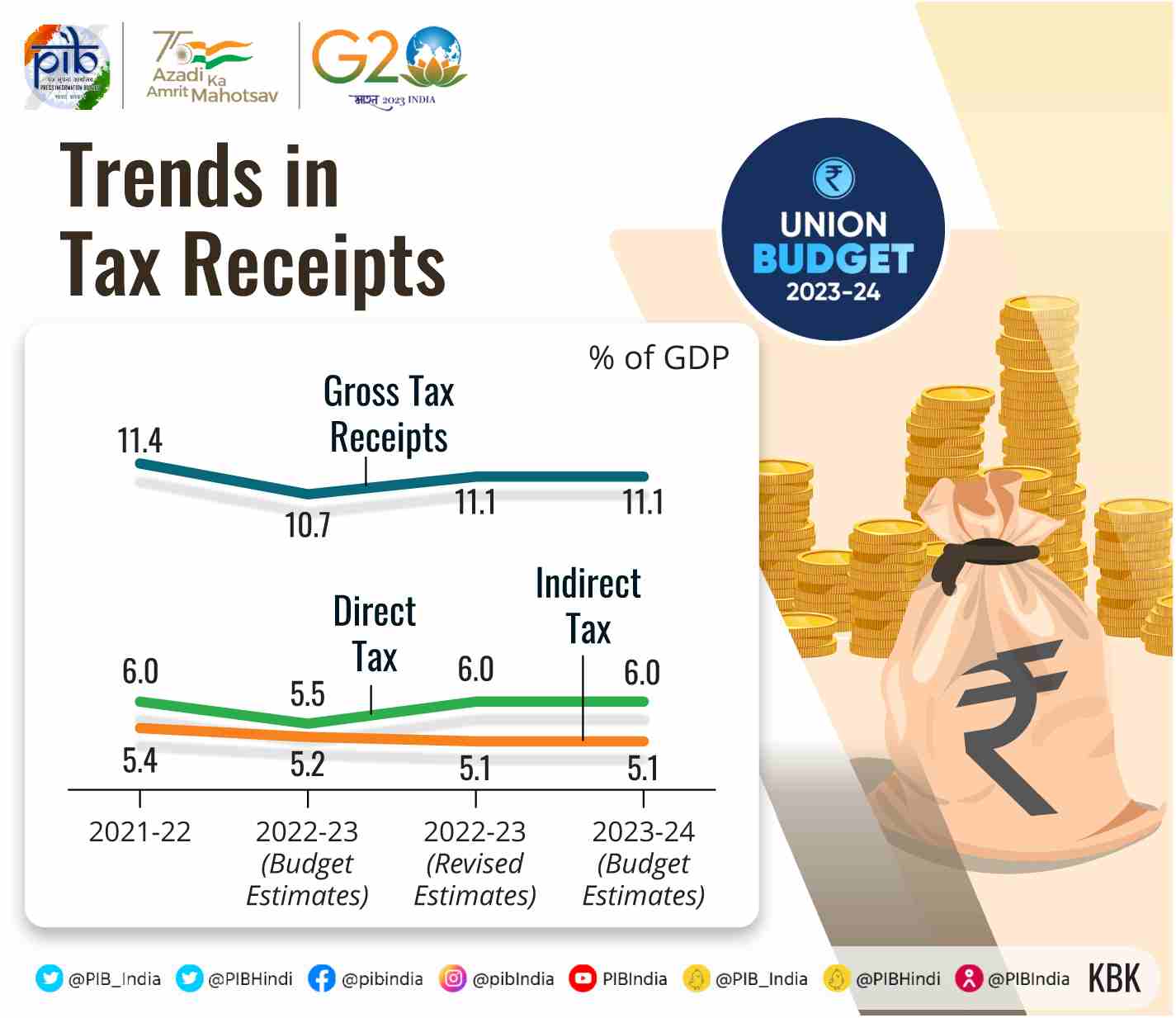

Union Budget 202324, Highlights, Vision, Priorities, Tax Slabs, Income tax, usc and prsi. 01 feb 2025, 09:53 pm ist.

Budget Watch Fiscal Year 2025 Rockville Reports Online, The 2025 national budget carries a deficit of 693 billion baht, against 593 billion baht in the 2025 fiscal year. Building on the framework of the revised national 2025 budget, prime minister yab dato' seri anwar bin ibrahim has stated that 2025 budget intends.

Budget 2025 in Pictures Important Facts and Numbers Explained in, Feb 16, 2025, 05:21 pm. Why some parents effectively pay a 71% tax rate;

An Analysis of the President’s 2025 Budget Congressional Budget Office, These tax cuts passed through the senate in february 2025, and include changes to the income ranges and tax rates in the marginal tax brackets. The changes made at autumn statement 2025 and spring budget 2025 mean that for single individuals on average salaries, personal taxes would be lower in.

Impact of Budget 2025 on Dividend Distribution Tax, In cbo’s projections, real consumer spending increases by 1.3 percent in 2025, roughly half of last year’s growth rate, and then rebounds in 2025 to grow by 1.9 percent. This document sets out the detail of each tax policy measure announced at spring budget 2025 and of previously announced measures that will be included in.

On taxation changes, the government will spend at least €1.2 billion, which is a small enough envelope once all the demands are.